Banking Marketplace: The Innovative Strategy to Diversify Revenue and Build Customer Loyalty

What is a Banking Marketplace?

A Banking Marketplace is a digital platform operated by a bank where third-party products and services are offered, typically from other sellers and brands, in addition to the bank's traditional financial products. This concept transforms the bank into a hub of shopping and convenience for its customers, combining physical and financial product offerings in one place. Some major players in the banking market, such as Banco Inter and Itaú, have already adopted this business model.In the banking marketplace model, the bank leverages its customer base and digital infrastructure (apps, websites, etc.) to enable the sale of a wide range of products and services — such as electronics, fashion, food, and home utilities — while offering benefits like cashback, financing, rewards programs, among others.

Main Features of a Banking Marketplace

Practical Examples

In Brazil and other markets, digital banks and fintechs are adopting the marketplace model to attract young and digitally active customers. They add the value of convenience and create an ecosystem where customers can perform multiple actions in a single environment, going beyond the traditional banking relationship.This concept positions the bank as a "one-stop-shop" for customer needs, expanding its relevance beyond financial services and increasing the institution's perceived value in the market.

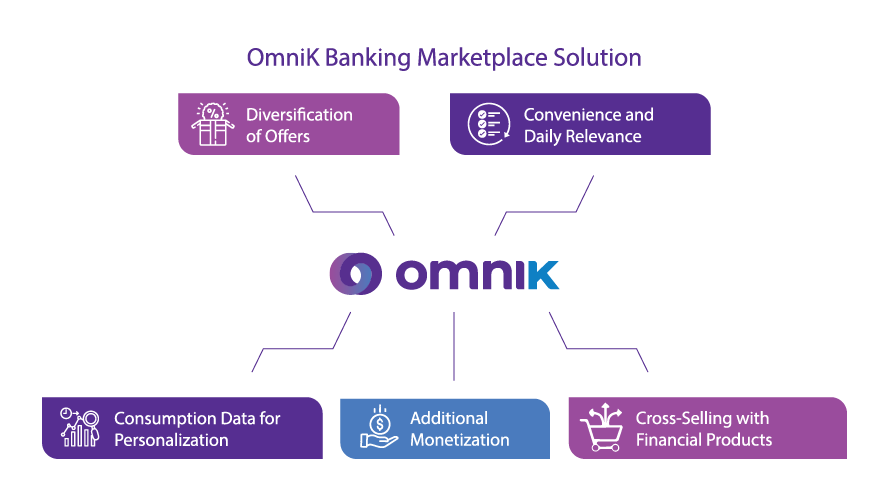

How OmniK Plays a Key Role in Banking Marketplaces

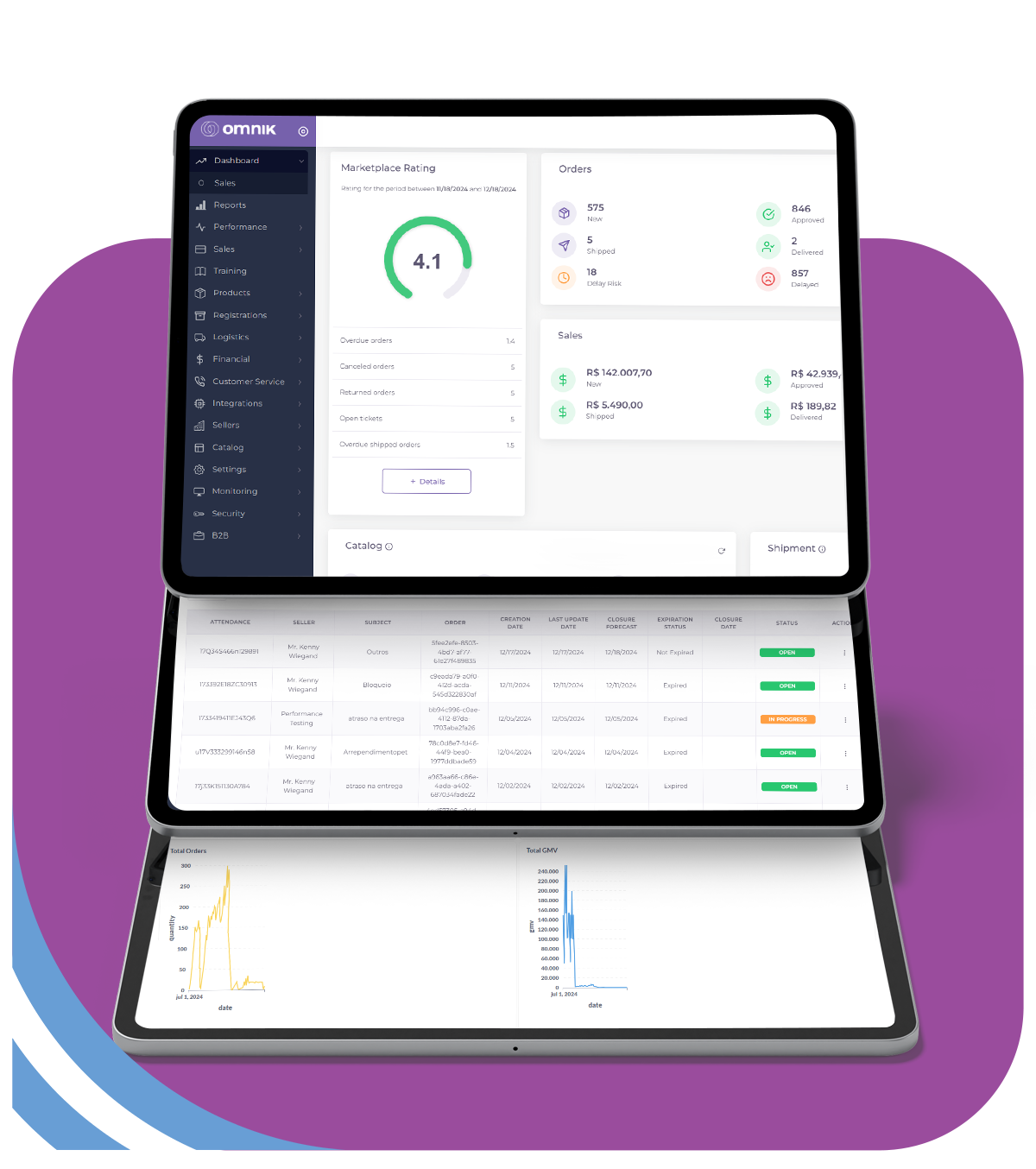

OmniK can play a crucial role in transforming a bank into a marketplace by providing a complete Seller Center infrastructure — a solution that facilitates the onboarding, management, and integration of sellers on the bank's platform.Here are some ways OmniK can help a bank become a marketplace:

1. Integration of Sellers and Centralized Management

OmniK simplifies the onboarding and integration of sellers into the platform, allowing the bank to quickly add a variety of vendors, brands, and products across different categories.

It offers centralized management, enabling the bank to control and supervise all sellers in one place, ensuring quality and compliance.

It offers centralized management, enabling the bank to control and supervise all sellers in one place, ensuring quality and compliance.

2. Inventory and Order Management

With OmniK's system, the bank can manage inventory and orders centrally, automatically updating availability and optimizing order flows.

This ensures the bank's customers have a seamless shopping experience with accurate product and inventory information.

This ensures the bank's customers have a seamless shopping experience with accurate product and inventory information.

3. Payment Solutions and Financial Reconciliation

Connecting sellers to the bank's payment methods, such as credit cards, account debits, personal loans, among others.

It automates financial reconciliation between the bank and sellers, simplifying commission payments and generating detailed reports.

It automates financial reconciliation between the bank and sellers, simplifying commission payments and generating detailed reports.

4. Cross-Selling with Banking Products

OmniK enables the bank to offer combined promotions, such as cashback, discounts on products for purchases made with the bank's cards, or financing for higher-value products.

This cross-selling integration helps increase transactions within the bank's ecosystem.

This cross-selling integration helps increase transactions within the bank's ecosystem.

5. Personalization and Retail Media

OmniK allows for a personalized customer experience by offering product recommendations and campaigns aligned with the bank user's profile.

The solution enables retail media within the marketplace, allowing sellers to promote specific products and targeted advertising campaigns, generating additional revenue for the bank.

The solution enables retail media within the marketplace, allowing sellers to promote specific products and targeted advertising campaigns, generating additional revenue for the bank.

6. Customer Service and After-Sales Support

OmniK's platform simplifies customer service and after-sales management, helping the bank provide efficient support to customers regarding third-party products and orders.

This ensures the customer experience aligns with quality standards, strengthening customer trust and satisfaction.

This ensures the customer experience aligns with quality standards, strengthening customer trust and satisfaction.

7. Reports and Data Analysis

OmniK provides detailed reports and insights on marketplace performance, from individual seller sales to customer purchasing behavior.

The bank can leverage this data to personalize offers, adjust sales strategies, and understand customer preferences.

The bank can leverage this data to personalize offers, adjust sales strategies, and understand customer preferences.

8. Scalability and Technical Support

OmniK offers a scalable solution that supports the bank's growth as a marketplace, accommodating an increasing customer and seller base.

The company also provides technical support and regular updates, ensuring the platform remains efficient and aligned with market best practices.

The company also provides technical support and regular updates, ensuring the platform remains efficient and aligned with market best practices.

9. Compliance and Security

OmniK's solution enables seller compliance verification and integrates security systems to protect customer data and ensure adherence to banking and regulatory standards.

10. Strategic Support and Consulting

OmniK offers strategic consulting to help the bank develop and optimize its marketplace, bringing expertise to implement campaigns, maximize monetization, and continuously integrate new features.

OmniK thus becomes a technological partner that helps the bank implement and operate an efficient marketplace, delivering a robust platform that provides a complete and integrated shopping experience for the bank's customers. This allows the bank to expand its value proposition and strengthen its customer relationships.

OmniK thus becomes a technological partner that helps the bank implement and operate an efficient marketplace, delivering a robust platform that provides a complete and integrated shopping experience for the bank's customers. This allows the bank to expand its value proposition and strengthen its customer relationships.

OmniK Provides Robust Security for Mission-Critical Operations

OmniK's robustness and security ensure that our clients operate with complete peace of mind, knowing their operations are protected and optimized.We are the platform that supports your business 360º: